يتم احتساب زكاة المال بناءً على نصاب ونسبة محددة في الإسلام. عادةً ما يجب إخراج 2.5٪ من الثروة الناضجة بعد الخصمات القانونية والديون. يمكن حساب زكاة المال عن طريق إجمالي الأموال المملوكة ثم حساب النصاب المالي واحتساب الزكاة على هذا الأساس. من الأمور التي يجب أخذها في الاعتبار هي عدم احتساب الأموال الخاضعة للديون أو الأموال المستثمرة في العقارات والأصول الثابتة.

زكاة المال: المفهوم والأهمية

تعد زكاة المال من الركائب الإسلامية الهامة، حيث تعتبر واجبًا دينيًا على المسلمين. تعني زكاة المال الاستقطاع والتصدق بجزء محدد من الثروة الناضجة لتوزيعها على فئات محددة من الناس المحتاجين. تعزز زكاة المال الروحانية وتعتبر وسيلة لتحقيق التكافل والتضامن الاجتماعي في المجتمع الإسلامي.

كيفية احتساب زكاة المال في الإسلام

يتم احتساب زكاة المال في الإسلام بأخذ جزء بسيط من الثروة الناضجة التي تملكها الشخص. تكون نسبة زكاة المال 2.5٪ من القيمة الإجمالية للمال بعد استقطاع الديون والنفقات الأساسية. يتم احتسابها بناءً على النصاب الذي يختلف من مال إلى مال وفقًا للقواعد الشرعية. يجب دفع زكاة المال في موعدها المحدد سنويًا.

كيفية احتساب زكاة المال

من هم المستحقون لزكاة المال

يحدد الإسلام فئات معينة تستحق استقبال زكاة المال. وتشمل هذه الفئات الفقراء والمساكين والمحتاجين والمسافرين والعاملين في جمع الزكاة وتوزيعها. يجب أن تذهب زكاة المال إلى هؤلاء الأشخاص لتحسين حياتهم ومساعدتهم على تلبية احتياجاتهم الأساسية. وتعتبر الزكاة وجوباً شرعياً لكل مسلم قادر على دفعها وتوجيهها إلى المستحقين المحددين.

الفقراء والمساكين: من يستحق زكاة المال

يشمل المستحقون لزكاة المال الفقراء والمساكين الذين لا يملكون ما يكفي لتلبية احتياجاتهم الأساسية. يتعين على الفقير أن يكون عاجزًا عن كسب المال بشكل كافي لمعيشته، بينما يستوجب على المسكين أن يمتلك ثروة لكنها لا تكفي لتلبية حاجاته. يجب توجيه زكاة المال إلى هؤلاء الأفراد لمساعدتهم في تحسين ظروف حياتهم والتخفيف من معاناتهم المادية.

الأسر المحتاجة والعاملون في جمع الزكاة

يشمل المستحقون لزكاة المال أيضًا الأسر المحتاجة، وهي الأسر التي تعاني من ضيق مالي وتحتاج إلى مساعدة مالية لتلبية احتياجاتها الأساسية. يمكن استخدام جزء من زكاة المال لتوجيهها لدعم هذه الأسر وتحسين ظروفها المعيشية. بالإضافة إلى ذلك، يُعد العاملون في جمع الزكاة مهمة حيث يقومون بتنظيم وجمع وتوزيع زكاة المال بطريقة صحيحة وعادلة للمستحقين.

نصيب الزكاة ونسبة الحسم

نصيب الزكاة هو المبلغ الذي يجب إخراجه من المال المستحق للزكاة، ويعادل 2.5٪ من إجمالي الأموال والاستثمارات للعام الحالي. أما الحسم فهو المبلغ الذي يمكن أن يخصم من المبلغ الإجمالي قبل حساب الزكاة، ويشمل الديون والنفقات الضرورية والضرائب المستحقة وغيرها. إذا تجاوزت الديون والنفقات الضرورية الحد المحدد، يجب دفع الزكاة على المبلغ الإجمالي للمال الذي يمتلكه الشخص.

كيفية احتساب زكاة المال

نسبة احتساب الزكاة: كم نسبة المال التي يجب إخراجها

نسبة احتساب الزكاة تعادل 2.5٪ من إجمالي الأموال والاستثمارات للعام الحالي. يجب على المسلمين دفع هذه النسبة من ثرواتهم المستحقة للزكاة. مثلاً، إذا كان لديك 10000 ريال، فإن نصيب الزكاة سيكون 250 ريال. هذه النسبة تضمن توزيع الثروة بشكل عادل ومساهمة في رفع مستوى المجتمع بأكمله.

الحسمات المسموحة: ما هي الحسمات التي يمكن أخذها في الاعتبار

عند حساب زكاة المال، هناك بعض الحسمات التي يمكن اخذها في الاعتبار. يمكن أن تشمل هذه الحسمات الديون المستحقة عليك والتكاليف الأساسية مثل الإيجار والفواتير وتكاليف العمل. أيضاً، يمكن اخذ صكوك الاستثمار الإسلامي وتعويض الخسائر المالية في الاعتبار. ومع ذلك، يجب الالتزام بقوانين الزكاة واحتساب الحسمات بدقة وعدم إساءة استخدامها للتهرب من الزكاة.

كيفية دفع زكاة المال

يمكن دفع زكاة المال عن طريق عدة طرق شرعية. يمكن للمسلمين دفعها مباشرة للفقراء والمحتاجين في المجتمع، أو من خلال مؤسسات خيرية. بعض الطرق الشائعة لدفع زكاة المال تشمل نقل المبلغ المالي مباشرة إلى الفقراء، أو دفعها عبر صناديق التبرعات الخيرية، وأيضًا الاستثمار في مشروعات تنموية تعود بالنفع على الفقراء والمحتاجين. تهدف جميع هذه الطرق إلى تنفيذ فرض الزكاة بشكل حقيقي ومستدام.

طرق دفع زكاة المال الشرعية

يمكن دفع زكاة المال الشرعية عن طريق العديد من الطرق المختلفة. يمكن للمسلمين دفعها مباشرة للفقراء والمحتاجين في المجتمع، أو عن طريق التبرعات للجمعيات الخيرية والمؤسسات الإسلامية. بالإضافة إلى ذلك، يمكن أيضًا استثمارها في مشروعات تنموية تعود بالنفع على الفقراء والمحتاجين. يهدف دفع زكاة المال الشرعية إلى تحقيق العدالة الاجتماعية وتنمية المجتمع الإسلامي.

احتساب زكاة المال

التبرعات والمؤسسات الخيرية كبدائل لدفع زكاة المال

يمكن للمسلمين أيضًا استخدام التبرعات ودعم المؤسسات الخيرية كبديل لدفع زكاة المال. يعد ذلك خيارًا مفيدًا لأولئك الذين ليس لديهم وقت أو مقدرة لتحديد المستحقين المباشرين للزكاة. يمكن توجيه التبرعات والمساهمات المالية للجمعيات الخيرية والمؤسسات الإسلامية التي تعمل على توزيع المساعدات والدعم للفقراء والمحتاجين. يعد هذا الخيار وسيلة فعالة لدعم المشروعات الخيرية وتعزيز التنمية المستدامة في المجتمع.

أهمية توجيه زكاة المال الصحيح

تكمن أهمية توجيه زكاة المال الصحيح في أنها تساهم في تحقيق عدة فوائد. فعندما يتم توجيه الزكاة بطريقة صحيحة وفقًا لأحكام الشرع، فإنها تساهم في تحسين أوضاع الفقراء والمحتاجين وتقليل الفقر والتشدد الاقتصادي في المجتمع. كما تعزز توجيه زكاة المال الصحيح العدالة الاجتماعية وتعين على توافر المساعدة لأولئك الذين هم في أمس الحاجة إليها.

تأثير توجيه زكاة المال بشكل صحيح على المجتمع

تأثير توجيه زكاة المال بشكل صحيح على المجتمع لا يمكن تجاهله. فعندما يتم توجيه الزكاة بحسب أحكام الشرع، فإنها تعمل على تحسين الظروف المعيشية للفقراء والمحتاجين في المجتمع. بالإضافة إلى ذلك، فإن توجيه الزكاة بشكل صحيح يعزز العدالة الاجتماعية ويساهم في خلق مجتمع أكثر تساويًا واستقرارًا. وبذلك، يشكل توجيه زكاة المال الصحيح جزءًا أساسيًا في بناء مجتمع مزدهر ومترابط.

الأفضلية في دعم الفقراء والمحتاجين بطريقة مستدامة

الأفضلية في دعم الفقراء والمحتاجين تكمن في تقديم الدعم بطريقة مستدامة تمكنهم من تحقيق الاستقلالية المالية على المدى الطويل. من خلال توفير التدريب المهني والفرص العملية ودعم القروض الصغيرة، يمكن للفقراء والمحتاجين أن يصبحوا أعضاء نشطين في المجتمع وأن يعيشوا بكرامة. إن الدعم المستدام يهدف إلى تغيير أوضاعهم الاقتصادية بشكل دائم بدلاً من توفير المساعدات المؤقتة.

الختام

ينبغي على المسلمين الالتزام بأحكام زكاة المال ودفعها بطريقة صحيحة وفي وقتها. فهي فرصة للتصدق وتحقيق الرحمة والتعاون في المجتمع. يجب على الأفراد الاستعانة بالمعاونة الشرعية والمراجعة الموثوقة لحساب زكاة المال وتوجيهها بالطريقة الصحيحة. هذا سيسهم في دعم الفقراء والمحتاجين وتحقيق تنمية اقتصادية مستدامة في المجتمع المسلم.

أهمية الالتزام بأحكام زكاة المال

ينبغي على المسلمين الالتزام بأحكام زكاة المال ودفعها بطريقة صحيحة وفي وقتها. فهي فرصة للتصدق وتحقيق الرحمة والتعاون في المجتمع. يجب على الأفراد الاستعانة بالمعاونة الشرعية والمراجعة الموثوقة لحساب زكاة المال وتوجيهها بالطريقة الصحيحة. هذا سيسهم في دعم الفقراء والمحتاجين وتحقيق تنمية اقتصادية مستدامة في المجتمع المسلم.

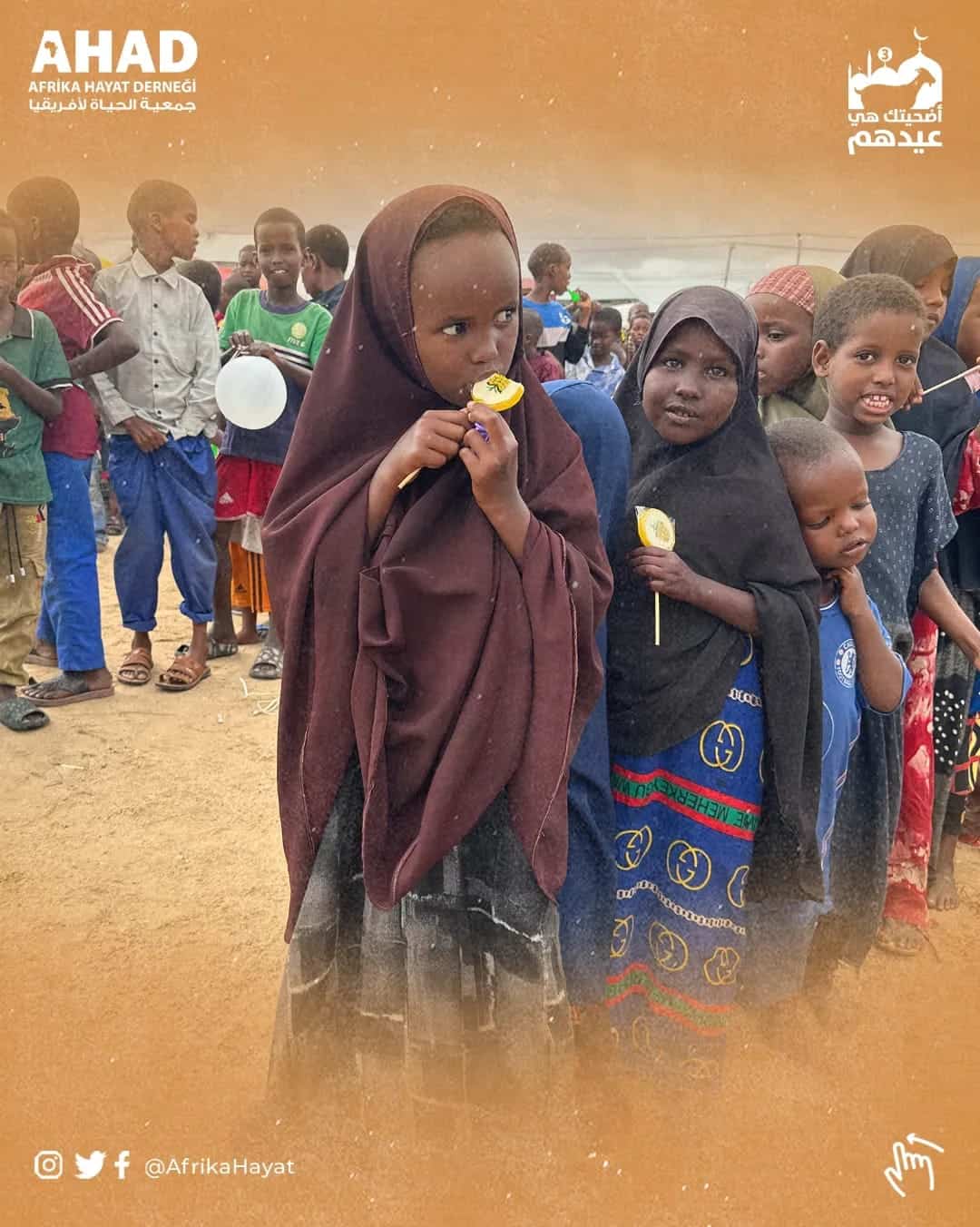

يمكنكم زيارة موقع جمعية ahad لتعرف على المزيد من المشاريع التي تقدمها

مقالات ذات صلة:

انضم إلينا في رسالتنا عبر تبرعك

تبرع الان